SushiSwap : Trade Crypto Effortlessly

Introduction SushiSwap:

SushiSwap is a decentralized, community-driven DeFi platform offering token swaps, liquidity provision, lending, staking, and cross-chain bridging. It empowers users to trade and earn yield across multiple networks with deep liquidity and transparent governance.

What is SushiSwap?

SushiSwap is an automated market maker (AMM) protocol originally forked from Uniswap, now evolved into a full DeFi ecosystem. It operates liquidity pools—called xPools—for permissionless token swaps and extends functionality via BentoBox vaults, Kashi lending markets, SushiBar staking, and the SushiXSwap cross-chain bridge.

- ✅ Permissionless token swaps via AMM pools

- ✅ Yield farming and liquidity incentives

- ✅ Isolated lending markets with Kashi

- ✅ Cross-chain transfers via SushiXSwap

SushiSwap Key Features:

- Swaps: Trade any ERC-20 pair with smart routing across multiple fee tiers (0.05%, 0.30%, 1.00%).

- Liquidity Provision: Deposit into xPools to earn trading fees plus boosted SUSHI rewards via Onsen.

- BentoBox & Kashi: Gas-efficient vaults enable limit orders, batch swaps, and isolated lending markets.

- SushiBar Staking: Stake SUSHI for xSUSHI and receive a share of protocol fees rebased continuously.

- SushiXSwap Bridge: Move assets seamlessly across Ethereum, Polygon, Arbitrum, BNB Chain, Optimism, and Fantom.

Step-by-Step Guide: How to Use SushiSwap

- Step 1 – Visit: Go to SushiSwap in your browser.

- Step 2 – Connect Your Wallet: Use MetaMask, WalletConnect, or Coinbase Wallet to sign in securely.

- Step 3 – Swap Tokens: Navigate to “Trade → Exchange,” select your tokens and fee tier, then confirm your swap.

- Step 4 – Provide Liquidity: Go to “Pool → Add Liquidity,” choose a pair and fee tier, approve tokens, and deposit to earn LP rewards.

- Step 5 – Lend or Borrow: Under “Lending → Kashi Markets,” select a market, supply collateral or borrow funds, and confirm.

- Step 6 – Stake SUSHI: Visit “SushiBar,” stake your SUSHI to mint xSUSHI, and start earning fee rebates.

- Step 7 – Bridge Assets: Open “Bridge,” choose source/destination chain, select token and amount, then transfer via SushiXSwap.

Core Capabilities of SushiSwap for Users

- Smart Routing: Aggregates liquidity across multiple pools for optimal pricing.

- Onsen Incentives: Extra SUSHI rewards for new and strategic liquidity pools.

- Isolated Risk: Kashi lending markets isolate counterparty risk per pair.

- Rebasing Rewards: xSUSHI holders continuously earn a share of protocol swap fees.

- Cross-Chain UX: One-click bridging across major EVM networks.

Why Use SushiSwap?

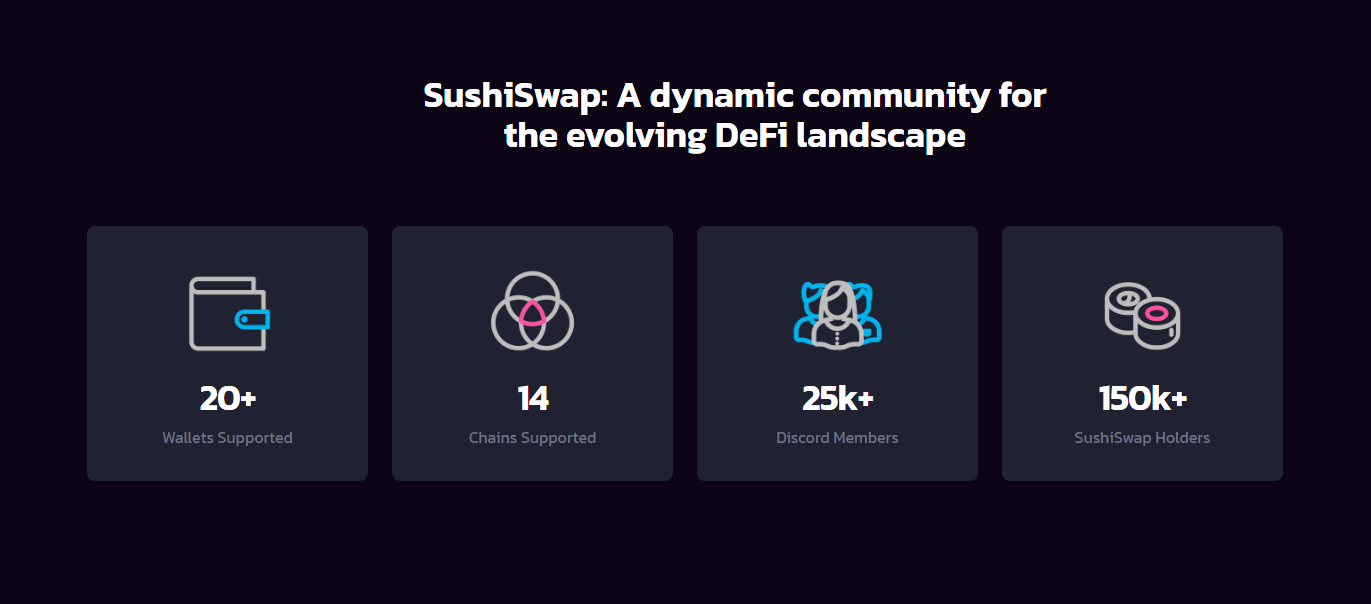

- Decentralized Governance: SUSHI holders vote on fees, feature upgrades, and treasury allocations.

- Capital Efficiency: Concentrated liquidity pools boost fee earnings and reduce impermanent loss.

- Modular Design: BentoBox and Trident enable advanced DeFi primitives with minimal gas overhead.

- Deep Liquidity: High TVL across pools ensures tight spreads and reliable execution.

- Community-Driven: Open-source development, bug bounties, and active Discord/Web3 community.

SushiSwap Security:

Core smart contracts are audited by PeckShield, QuantStamp, and CertiK. A robust bug bounty program (up to \$500K) incentivizes ongoing vulnerability discovery. All upgrades use a 48-hour multisig timelock to allow community review before execution.

Supported Assets:

SushiSwap supports hundreds of ERC-20 tokens and major stablecoins (USDC, USDT, DAI), as well as ERC-721 and ERC-1155 NFTs. Trident pools also enable custom asset combinations with flexible fee tiers.

Trading Experience on SushiSwap

The SushiSwap interface combines intuitive UX with professional-grade analytics: advanced charts, fee tier selection, routing breakdowns, and real-time PnL tracking. With community incentives and cross-chain access, SushiSwap offers a comprehensive DeFi experience.

Pro Tip:

FAQ

- Q1: How do I earn SUSHI?

Provide liquidity, stake in SushiBar, or participate in Onsen-incentivized pools. - Q2: Which fee tier should I choose?

0.05% for stable pairs, 0.30% for most swaps, 1.00% for exotic pairs. - Q3: Can I migrate from Uniswap?

Yes—use the “Migrate” tool under Pool to seamlessly transfer Uniswap v2 LP positions. - Q4: How is governance handled?

SUSHI holders vote on Snapshot; on-chain changes execute after a 48-hour timelock. - Q5: Is SushiSwap secure?

Fully non-custodial, audited, and backed by an active bug bounty program.

Conclusion:

SushiSwap redefines DeFi by offering a modular, community-driven ecosystem for swaps, liquidity, lending, staking, and cross-chain bridging. Its deep liquidity, capital-efficient pool designs, and transparent governance make it a top choice for traders, yield-seekers, and developers alike. Explore SushiSwap today for a seamless, secure, and rewarding DeFi experience.